How Can Corporations Get Board Size “Just Right” To Meet ESG Goals?

Have you ever bought a product because the packaging was covered in leaves and "all-natural" labels, only to find out later that the company behind it is actually one of the world’s biggest polluters? That frustrating gap between what a company says and what it actually does is called greenwashing.

A groundbreaking new study published in PLOS One by researchers Jingzhuo Yu and Yong-Sik Hwang (2026) has uncovered a surprising secret to stopping this behavior. It turns out that the key to a company’s honesty isn't just about their mission statement—it’s about the people sitting in the boardroom and, specifically, how many of them there are.

By looking at data from over 12,000 company-year observations in China between 2009 and 2023, the researchers found that corporate "honesty" follows a very specific pattern based on the size and diversity of their board of directors. If you’re a future investor, a conscious consumer, or just someone interested in how the world’s biggest businesses work, understanding this "Goldilocks" effect is essential.

How Many Board Members Do You Need For a Sustainable Company?

If you were born in the 80s you likely remember the question of how many licks are needed to get to the center of a tootsie roll pop. Questionable advertising, but effective nonetheless.

For years, experts have argued about whether a big board of directors is better or worse than a small one. Some said big boards are better because they have more experts. Others said they are worse because they get bogged down in bureaucracy and arguments.

This study finally found the answer: it’s a curve.

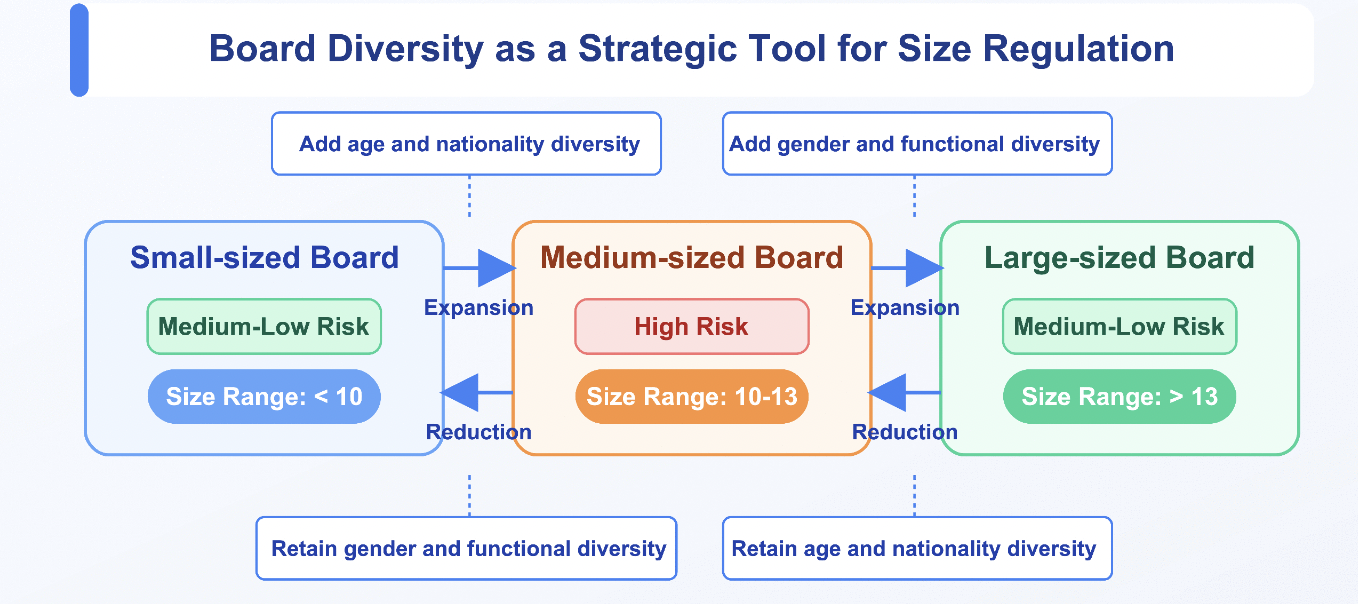

The researchers discovered an inverted U-shaped relationship between board size and greenwashing. Here is how it breaks down:

Small Boards (Under 10 members): These boards tend to have lower greenwashing. Why? Because in a small group, it’s harder to hide. Directors are more accountable, and they monitor the CEO much more closely. There is less "opportunity" to lie.

The "Danger Zone" (10–13 members): This is where greenwashing peaks. In medium-sized groups, the board is large enough that oversight starts to get messy and unorganized, but it’s not yet large enough to have the massive resources needed to actually fix the company’s environmental problems.

Large Boards (14+ members): Interestingly, greenwashing starts to drop again once boards get very large. These massive boards have so many experts and connections that the company can actually achieve real ESG improvements, which reduces the pressure to fake it.

“The highest risk of greenwashing occurs when a company has 11.2 directors (on average). If a board is in that 10–13 member range, they are in the "high-risk" zone for being more talk than action.”

Why Do Companies Lie?

To understand why this happens, the researchers used a concept called the Fraud Triangle. Imagine three sides that must be present for someone to commit a "crime" like greenwashing:

Pressure: The company feels they must look green to keep investors happy or satisfy government rules.

Opportunity: The board is too disorganized or distracted to notice that the reports don't match reality.

Rationalization: The bosses tell themselves, "Everyone else is doing it; it’s just a marketing strategy."

Small boards cut off the Opportunity (they watch closely). Large boards reduce the Pressure (they have the resources to actually be green). But medium-sized boards get stuck with a bit of both, creating the perfect storm for greenwashing.

Diversity - The Secret to Honesty

The study didn't just look at how many people were in the room; it looked at who they were. This is where things get really interesting for anyone interested in social justice and corporate fairness.

The Power of Two (Gender Diversity)

The researchers found that simply having one woman on a board isn't enough to change the culture—a phenomenon sometimes called "tokenism." However, they discovered a "Critical Mass" threshold. Once a board has at least two female directors, greenwashing significantly decrease. Women on boards are often more sensitive to social and environmental issues and are more likely to challenge "shady" behavior from management. They bring a "resource-based" boost that helps the company actually perform better, rather than just talking about it.

Functional Diversity (The Expert Mix)

If a board is made up only of accountants, they might miss environmental risks. The study found that boards with directors from many different backgrounds (finance, engineering, law, etc.) are much better at stopping greenwashing. This "collective intelligence" helps them spot lies and solve real-world problems more effectively.

Nationality Diversity (The Outsider Perspective)

Having foreign directors on a board acts like a "super-cop" mechanism. Foreign directors are often more independent and less likely to be part of local "good old boy" networks. Because they follow international standards, they tend to flatten the greenwashing curve and keep companies honest.

Age Diversity (The Generational Bridge)

A board with a mix of young and old directors is less likely to fall into "group think." While different ages can sometimes lead to more arguments, this friction actually helps prevent companies from making unchallenged, "fake" green claims.

What Should Companies Do?

Avoid the "Danger Zone": If your board has 11 members, you are at the highest risk for greenwashing. You should either shrink the board to under 10 (to improve oversight) or expand it (to add more experts).

The Two-Woman Rule: Don't just hire one woman to check a box. Aim for at least two (or more) to reach that "critical mass" where their voices actually change company policy.

Hire Outsiders: If you are a small company and you start to grow, prioritize hiring people with different nationalities and ages. This helps keep you honest while you are still finding your footing.